Digitization of shares: From paper certificates to electronic uncertificated securities under Swiss law

Introduction

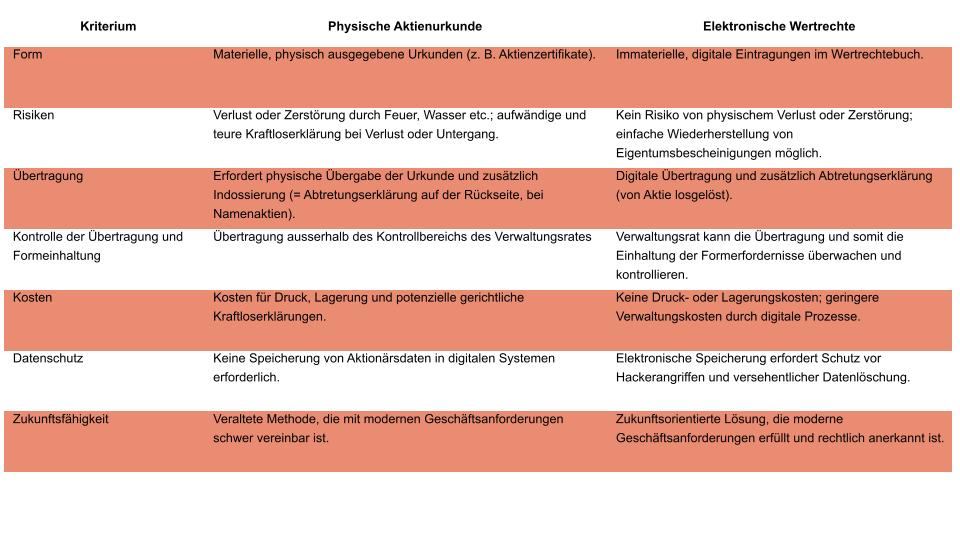

Digitalization does not stop at company law. Many Swiss companies are faced with the decision to replace their traditional paper shares with modern electronic uncertificated securities. This blog post examines the advantages and disadvantages of both options in the context of Swiss law and shows why the dematerialization of shares is becoming increasingly important.

Table of contents

- Paper shares under Swiss law: a dying form?

- Electronic book-entry securities: the digital alternative to paper shares

- Risks of physical share certificates: Why companies are doing away with paper shares

- Challenges in the transfer of paper shares

- Advantages of digitalization: Why shares should go digital

- Legal aspects of the dematerialization of shares

Paper shares under Swiss law: a dying form?

Physical share certificates, often referred to as paper shares, are documents enshrined in Swiss company and securities law that embody the ownership of shares in a company. They can be issued as individual share certificates or as share certificates that combine several shares in one certificate. These certificates must meet certain legal requirements, such as stating the nominal value, the share number and the signature of a member of the Board of Directors.

Despite the increasing trend towards digitalization, paper shares are still widely used in Switzerland. It is assumed that they are still the form of share chosen by the majority of Swiss stock corporations and are therefore likely to be the most commonly used form of share. This applies in particular to small and medium-sized unlisted companies, which often adhere to traditional structures.

Electronic book-entry securities: the digital alternative to paper shares

Under Swiss company law, electronic uncertificated securities are a modern form of uncertificated shares that serve as an alternative to paper shares. They represent a dematerialization of shares and exist only as an entry in the company's book-entry rights register. According to the Swiss Code of Obligations, uncertificated securities are rights with the same function as securities, but without physical embodiment.

There are two main types of electronic book-entry securities under Swiss company law:

- Simple uncertificated securities: These are created by entry in the issuer's uncertificated securities register and are transferred by written declaration of assignment.

- Registered securities (share tokens): These are designed as cryptographic tokens on a blockchain and represent a digital substitute for securities.

Electronic uncertificated securities offer a modern, digital alternative to paper shares and enable more efficient management and transfer of shares. They are becoming increasingly important, especially for newly founded stock corporations in Switzerland.

Risks of physical share certificates: Why companies are doing away with paper shares

Paper shares entail considerable risks and disadvantages that are prompting many companies to do away with them:

- Loss: Share certificates can be lost, leading to legal and administrative complications.

- Destruction: Destruction by fire, water or other circumstances represents a real risk that jeopardizes the existence of the document.

- Declaration of invalidity in the event of loss or destruction: This process is costly and time-consuming, often taking up to a year.

These risks can be equally problematic for companies and shareholders and lead to considerable financial and administrative burdens. The Board of Directors is particularly affected by these challenges, as it is responsible for restoring, invalidating or correcting the share register, which costs it time, money and nerves.

Challenges in the transfer of paper shares

The transfer of paper shares is associated with hurdles that complicate the process:

- Need for physical handover: This can be impractical in an increasingly digital world.

- Complex legal requirements: The endorsement of registered shares in particular is an often overlooked hurdle.

- Risk of incorrect transfers: Without correct endorsement, no transfer of ownership will take place.

Upon endorsement, the seller must draw up and sign a declaration of assignment on the reverse of the registered share. This formal requirement is largely unknown among many shareholders, which means that registered shares are often transferred without correct endorsement. As a result, ownership of the share in question is not transferred to the buyer. For the company, this results in an interrupted or incorrect chain of ownership, which can lead to legal, financial and administrative problems (more on this in a separate blog).

Advantages of digitalization: Why shares should go digital

Electronic uncertificated securities offer numerous advantages that speak for the digitization of shares:

- Increased security: By eliminating the risk of physical loss, the risk of loss or destruction is eliminated.

- Cost efficiency: The elimination of custody costs and the reduction in administrative expenses lead to significant savings.

- Simplified administration: Digital share register management enables more efficient administration and reduces sources of error.

- Flexibility: New certificates of ownership can be issued quickly and easily, which simplifies handling.

- More efficient transfer processes: Digital processes significantly accelerate and simplify the legally compliant transfer of shares.

- Control by the Board of Directors: The Board of Directors can better monitor and control the transfer and the fulfillment of formal requirements.

These advantages make electronic book-entry securities an attractive option for modern companies that value efficiency, security and transparency. They enable better control over share holdings and movements and reduce the risk of errors or irregularities in transfers.

Legal aspects of the dematerialization of shares

In Swiss law:

- Electronic book-entry securities are legally recognized and offer a secure alternative to paper shares.

- The transfer is legally simplified, which speeds up transactions and increases legal certainty.

- Digital processes correspond to modern business practices and facilitate compliance with regulatory requirements.

- The legal recognition underlines the future viability of electronic book-entry securities in the Swiss financial sector.

This legal recognition and the associated advantages make electronic uncertificated securities a forward-looking option for Swiss companies wishing to modernize their share structure.

Conclusion

The digitization of shares through electronic book-entry securities offers significant advantages in terms of security, efficiency and cost savings. Companies in Switzerland should seriously consider converting from paper shares to digital forms in order to benefit from these advantages and prepare for the future.

Konsento offers electronic share registers and securities registers that are free of charge for up to 150 shareholders. In addition, Konsento supports the implementation of legal processes for the dematerialization and cancellation of physically issued share certificates with digital, efficient and cost-effective processes. It is particularly noteworthy that Konsento informs the Board of Directors of the specific formal requirements for each type of transfer. In the course of transferring shares in the form of electronic uncertificated securities, they can create assignment declarations directly in the system. This makes the transition to electronic uncertificated securities particularly attractive, accessible and legally secure for Swiss companies.

Would you like to learn more about the advantages of digitizing shares or receive support in converting paper shares to electronic book-entry securities? Get in touch with us today for a free consultation!

Sign up for our newsletterto stay up to date with company management.

Or follow us on social media: