The importance of corporate governance for companies in equity crowdfunding

Modern forms of financing In today's dynamic business world, companies are constantly looking for innovative ways to raise capital and engage their community. Equity crowdfunding - also known as crowdinvesting - has proven to be an effective method in this context.

Fiduciaries and notaries under the spell of the skills shortage: innovation strategies for a prosperous future

The shortage of skilled workers poses immense challenges for many industries, but the fiduciary and legal sector is particularly hard hit. Finding qualified staff is becoming increasingly difficult, which can affect the efficiency and quality of services. But instead of burying our heads in

Regulations of the Board of Directors on Electronic Means at the General Assembly

A guide for board members Since the beginning of the year, general meetings can also be held as virtual or hybrid meetings using electronic means. With these new forms of AGM, the legislator is taking account of technical and social developments and promoting the participation and involvement of shareholders in

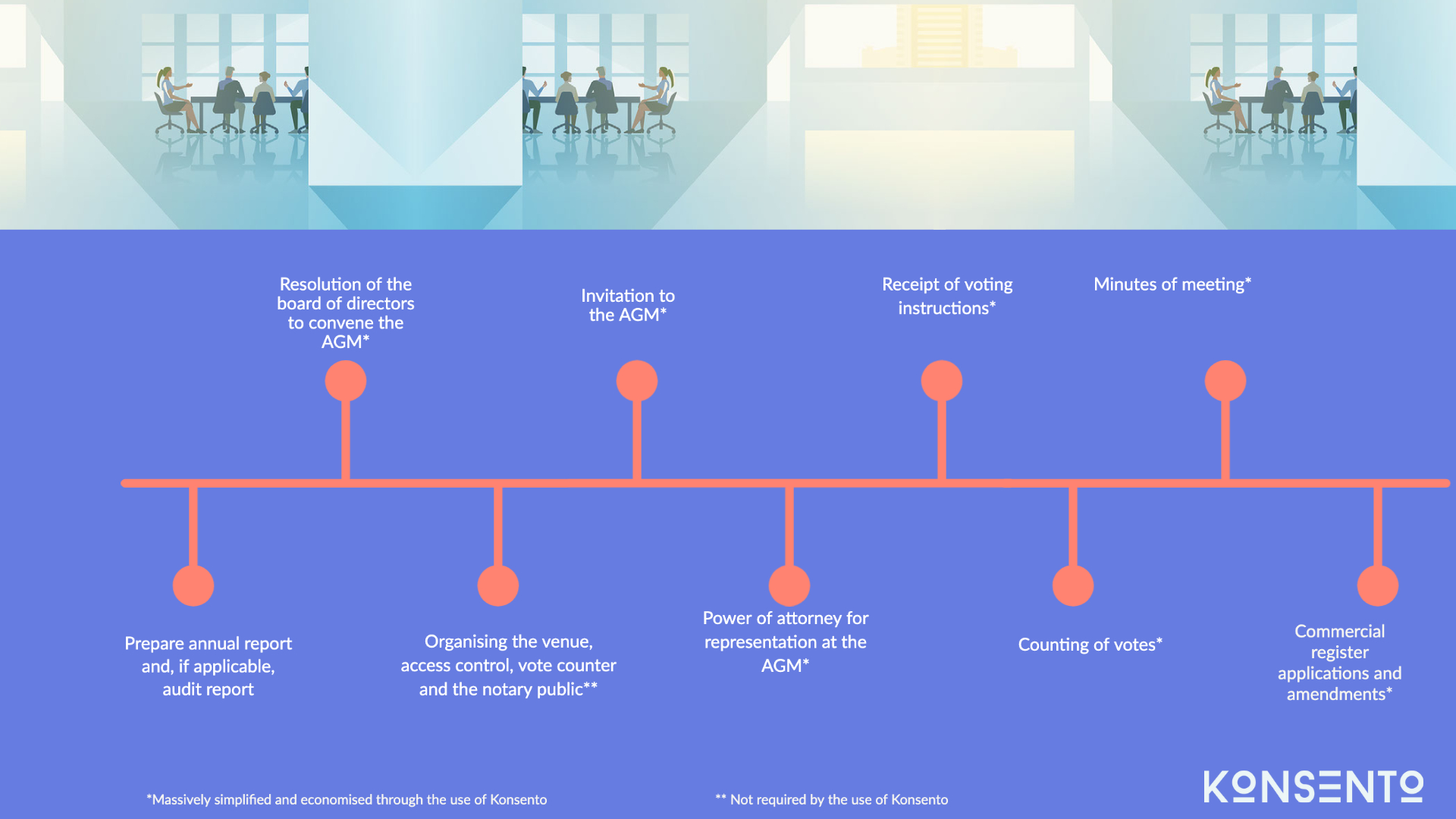

Checklist: What to consider when planning an AGM

Key Facts

- Prepare annual report and, if requested (no opting-out), audit report in a timely manner.

- Plan the AGM early and hold it no later than 6 months after the end of the financial year (usually by 30 June, convened by the board of directors).

- In case of planned changes to the articles of association (capital increase, change of domicile, etc.), the texts of the articles of association and a notary public must be organised.

- The invitation to the AGM, including agenda items and motions (with attachments, if applicable), must be received by the shareholders at least 20 days before the date of the AGM.

- Physical, hybrid or virtual AGM must be held with counting of votes and taking of minutes.

- For all the above tasks (excluding annual and audit reports), Konsento software offers simple and managed workflows and templates that lead to massive time and cost savings and effortless legal compliance.

Revision of company law: The new forms of the general meeting of shareholders

The coronavirus pandemic and the lockdown in spring 2020 helped Swiss stock corporations to modernize company law at an early stage: the Federal Council issued a Covid Ordinance allowing shareholders to exercise their rights in electronic form. In doing so, it created an instrument at an early stage

Online notarization of general meeting resolutions

The Covid-19 pandemic and the lockdowns and home office obligations imposed to combat it have massively accelerated digitalization: Consumers have increasingly shopped via online channels, and companies have introduced video conferencing and online tools across the board. Due to the ban on gatherings, companies in the context of

Simple. Together. Syndicate.

A syndicate is an investment vehicle that enables investors to invest in the best startups on the market together with relevant and renowned lead investors. Whether experienced business angel or neo-startup investor - everyone benefits A co-investment syndicate is a grouping of interests and interests of investors.

General assemblies with the possibility of Internet participation

Options for action by stock corporations in the light of event bans Current Swiss law allows companies to hold general meetings in which, in addition to the Board of Directors, some of the shareholders are physically present, while the other shareholders attend the event via the Internet.

The abolition of registered shares and its consequences for shareholders and companies

In addition to the coronavirus pandemic and its economic impact, it was almost forgotten that another drastic event was approaching for Swiss stock corporations: the abolition of bearer shares by law and the forced conversion of existing bearer shares into registered shares. The corresponding legal basis has already been

Company restructuring without fixed interest payments and dilution of voting rights

The coronavirus pandemic and its economic consequences are causing economic hardship for countless companies. Participation certificates with preferential rights balance the interests of existing company owners and new investors because, while the company compensates investors appropriately for the risks they have taken on, the new investors do not receive any compensation.