How does a capital increase work? Steps of a capital increase

In a nutshell:

Around 4,000 to 5,000 capital increases are carried out in Switzerland every year. In 2022, Swiss startups raised almost CHF 4 billion through capital increases alone. This corresponds to 383 financing rounds and represents a small proportion of the total number of capital increases. The majority is accounted for by established SMEs that are financing their growth or reorganising their balance sheet. The number of financing rounds in Switzerland has risen steadily in recent years, but 2023 could be an exception due to the economic situation.

Capital increases are subject to strict legal regulations and are extremely complex due to formal requirements. Notaries notarise and register them with the commercial register, carefully checking that all formal requirements are met.

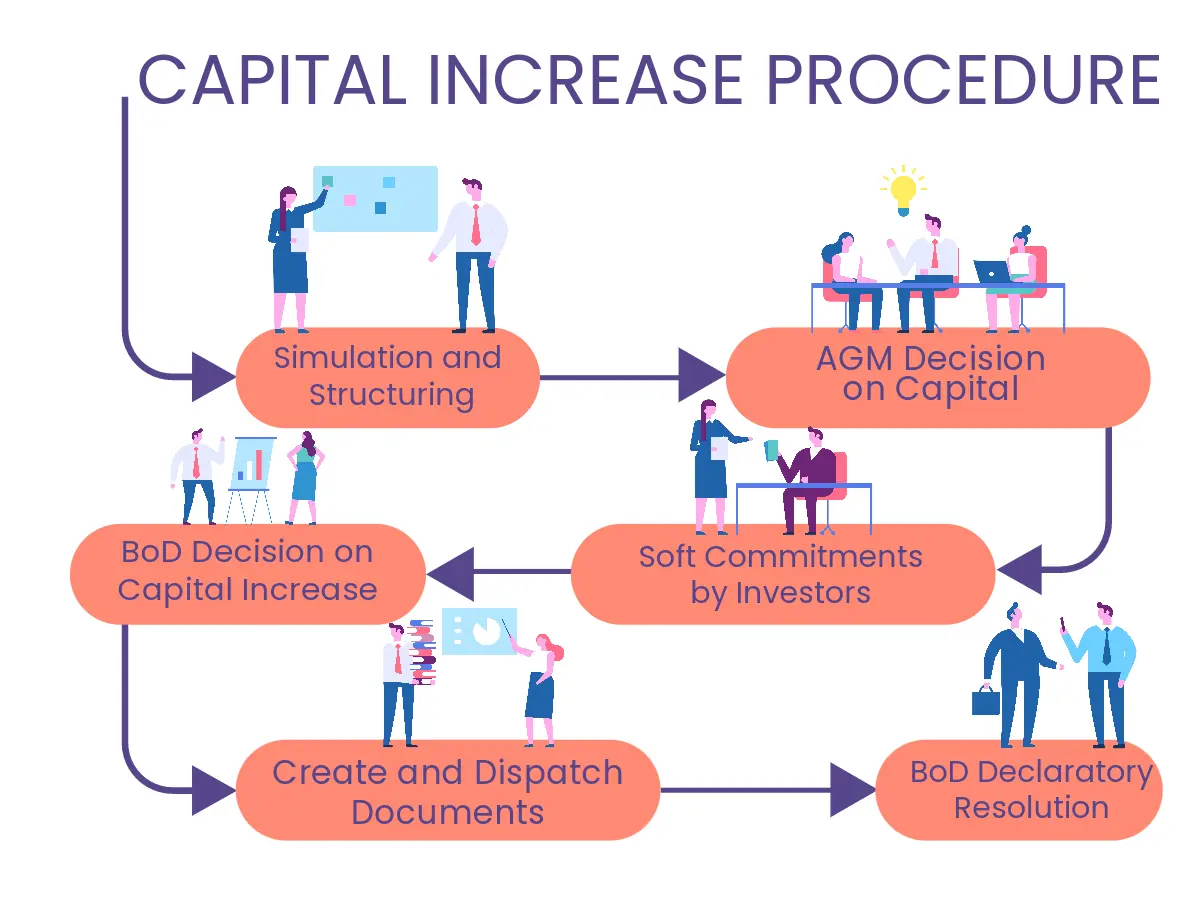

In order to reduce the complexity, we offer here a rough overview of the main steps of a capital increase for entrepreneurs and board members.

- Simulation and structuringnalysis of financing requirements, valuation of the company, simulation of issue price, number of shares and dilution.

- neral meeting resolution:Shareholders decide on a capital increase at an ordinary or extraordinary general meeting, publicly notarised.

- Financing commitments from investors:Collection of financing commitments ("soft commitment") with comprehensive legal data from investors.

- Capital increase resolution of the Board of Directors:Once sufficient financing commitments have been made, the Board of Directors decides on the capital increase and determines the details.

- Creating and sending documents:Creation of all necessary documents for public notarisation and commercial register registration.

- Resolution of the Board of Directors and amendment of the Articles of Association:review of the capital increase carried out, amendment of the Articles of Association, notarisation and registration with the commercial register.

Digitalisation can simplify the process considerably. Konsento offers tools for organising meetings, templates for agenda items, electronic voting, automatically generated minutes, a portal for funding commitments and the fully automated creation of all documents required for public notarization. The entire process is significantly accelerated by digitalised processes and leads to cost and time savings of up to 50%.

Between 4,000 and 5,000 capital increases are carried out in Switzerland every year. In 2022, Swiss start-ups alone raised almost CHF 4 billion through capital increases, although these only accounted for a small proportion of the total number of capital increases with 383 financing rounds. High amounts are therefore also likely to have been channeled into established SMEs, which either used them to finance their growth or restructure their balance sheets. Overall, the number of capital increases carried out in Switzerland has risen steadily in recent years.

Capital increases follow legally prescribed rules and are highly complex due to the strict formal requirements. As capital increases must be publicly notarised by a notary and registered with the commercial register, correct compliance with all formal requirements is meticulously checked. This means that the adage "where there is no plaintiff, there is no judge", which is otherwise applicable to company law, does not apply to capital increases.

In order to reduce the complexity for entrepreneurs and board members and simplify planning, we provide a rough overview of the main steps involved in a capital increase below.

The variety of possible forms of capital and the number of rules that need to be taken into account exceed the scope of a single blog post, which is why we are deliberately focussing on the essential steps.

Simulation and structuring

Once the capital requirements have been determined, a capital increase often begins with an analysis of the specific financing requirements and a valuation of the company. On this basis, the issue price of the shares, the necessary number of shares to be issued and the dilution of existing shareholders can be simulated. Of course, these results are not carved in stone and are further honed in discussions with potential investors, who contribute their own views to the valuation of a company. It is therefore entirely conceivable that steps 1 and 2 could be swapped in terms of order.

General meeting resolution

The company's shareholders decide to introduce one at an ordinary or extraordinary general meeting (GM). Capital bands, from conditional capital or one ordinary capital increase. This resolution must be publicly certified by a notary. In the case of a capital band or conditional capital, the statutes must also be adjusted. There are legal limits on the amount of the increase from the capital band or conditional capital amounting to 50% of the previous capital. The exact capital requirements and the details of the capital increase are often not yet known at this point, which is why the maximum amounts are decided and included in the statutes. With an ordinary capital increase, however, the general meeting decides to increase the capital by a specific or maximum amount, which is not limited by law.

Financing commitments from investors

The next step is to collect financing commitments from investors. In practice, this process is known as "soft commitment". For the company seeking capital, it is of course at the centre of the financing round - alongside the payment of the committed funds. From a legal perspective, however, it is first and foremost a matter of obtaining all the necessary data from the future shareholder or participant that is relevant for the preparation of all the necessary documents. In order to be able to carry out the legal process of a capital increase as quickly as possible, more precise information must be collected than "Hans Muster would like to invest CHF 100,000".

Resolution of the Board of Directors to increase capital

As soon as there are sufficient financing commitments from investors to be able to carry out the financing, the Board of Directors must decide to increase the capital in the case of the capital band or an authorised capital increase under the old law. Capital increases within the scope of authorised capital are possible until the end of 2024 at the latest, depending on when they are introduced into the Articles of Association. An increase resolution by the Board of Directors is not required for ordinary and contigent capital increases.

As part of the Board of Directors' resolution on the capital increase, the Board of Directors determines the specific nominal amount of the increase as well as the nominal value, the issue price, the number and type of new shares or participation certificates to be created, any preferential rights and transfer restrictions, the start of dividend entitlement and the type of contribution. In addition, the resolution sets out any restrictions or cancellation of subscription rights. This resolution can also be made in writing or electronically, but must in any case be properly recorded and signed by the Chairman and the Secretary of the Board of Directors, as it must be submitted to the notary as part of the declaratory resolution.

Create and send documents

Once the Board of Directors has formally approved the capital increase and determined its details, the most challenging administrative phase of the capital increase takes place: all information relevant to the capital increase must be accurately and completely transferred to the documents required for public notarisation and registration in the commercial register. Depending on the type of contribution, this includes the subscription certificate or the exercise declaration of the subscribing investors, any waiver declarations of existing investors, the capital increase report and declaration of the board of directors, the amended articles of association, Lex Koller/Lex Friedrich declarations, stamp duty declarations, any audit reports and the application to the commercial register. Depending on the agreements within the stock corporation and the existing shareholders, a shareholders' agreement and a pooling/syndicate agreement may also be required. In addition, the bank that manages the company's capital contribution account must be informed of the paying investors.

Resolution of the Board of Directors and amendment to the Articles of Association

Once the final capital contribution has been received, the Board of Directors holds another meeting to formally confirm that the capital increase has been carried out and completed correctly. This involves checking whether all shares or participation certificates have been validly subscribed, the promised contributions correspond to the total issue amount of the shares or participation certificates, the requirements of the law, the Articles of Association and the resolution of the Annual General Meeting have been met, there are no contributions or special benefits other than those officially stated in the supporting documents and all necessary supporting documents are complete and correct. The latter are almost all documents that were created in the previous step. This does not apply to shareholder pooling and pooling agreements. The Board of Directors also decides to amend the Articles of Association to reflect the changed capital. A notary confirms that all relevant documents were presented to him during the meeting and notarises the resolution and the amendment to the Articles of Association. The capital increase is then registered with the commercial register. Only when the new capital has been entered in the commercial register does the bank release the funds paid into the capital contribution account.

Simplification through digitalisation

The process described above shows that capital increases are complex procedures that follow strict formal rules. How well these are followed from the outset determines how quickly a capital increase is completed and the company gains access to the paid-in capital.

Once the final capital contribution has been received, the Board of Directors holds another meeting to formally confirm that the capital increase has been carried out and completed correctly. This involves checking whether all shares or participation certificates have been validly subscribed, the promised contributions correspond to the total issue amount of the shares or participation certificates, the requirements of the law, the Articles of Association and the resolution of the Annual General Meeting have been met, there are no contributions or special benefits other than those officially stated in the supporting documents and all necessary supporting documents are complete and correct. The latter are almost all documents that were created in the previous step. This does not apply to shareholder pooling and pooling agreements. The Board of Directors also decides to amend the Articles of Association to reflect the changed capital. A notary confirms that all relevant documents were presented to him during the meeting and notarises the resolution and the amendment to the Articles of Association. The capital increase is then registered with the commercial register. Only when the new capital has been entered in the commercial register does the bank release the funds paid into the capital contribution account.

Sign up for our newsletterto stay up to date with company management.

Or follow us on social media: